Therapy isn't just about the copay - here's what else you're really paying

You show up for your therapy session, swipe your card, and pay $30. Easy. But that $30? It’s just the tip of the iceberg. If you think that’s your total cost for therapy, you’re setting yourself up for a financial surprise. Many people don’t realize their insurance plan might be costing them thousands more over the year - even if they have coverage.

Let’s say you’re seeing a therapist weekly. At $30 per session, that’s $1,560 a year. Sounds manageable, right? But what if your deductible hasn’t been met yet? What if your plan uses coinsurance instead of a flat copay? What if you need 20 sessions instead of 12? Suddenly, that $30 becomes $125 - then $75 - then $150. And you didn’t see it coming.

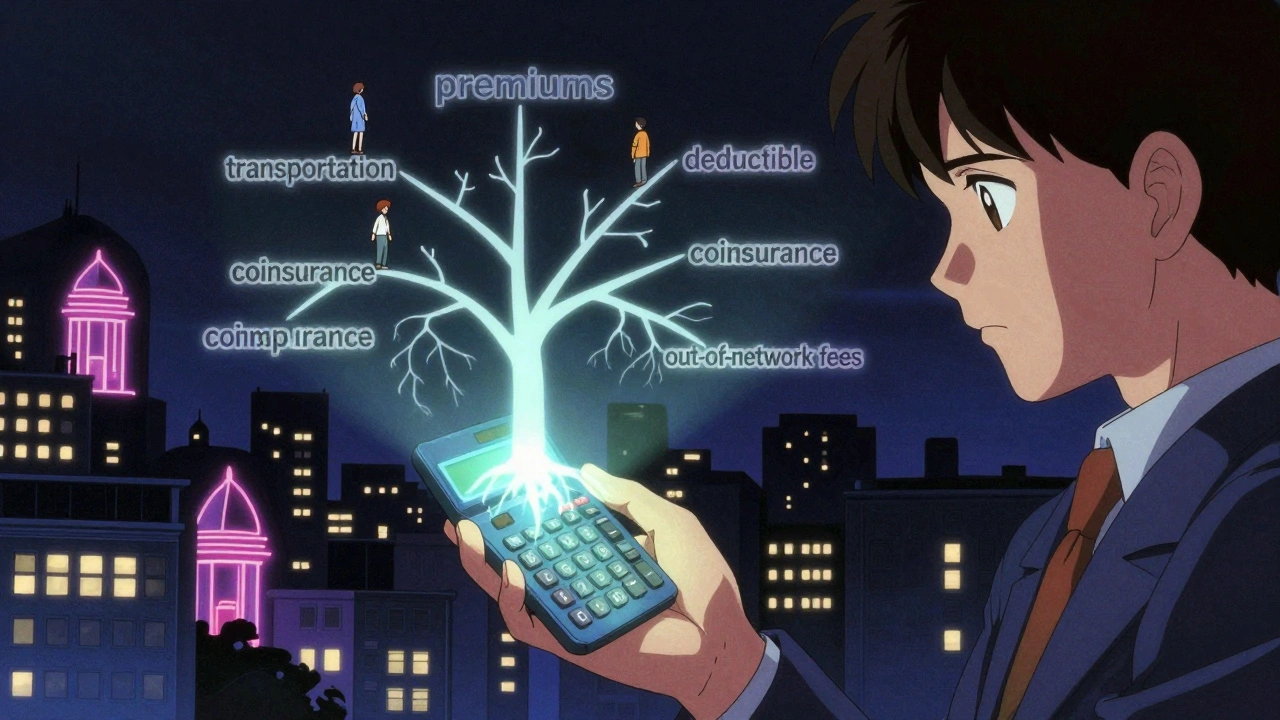

Here’s the truth: therapy cost isn’t just what you pay at the door. It’s your monthly premium, your deductible, your coinsurance, your out-of-pocket maximum, and whether your provider is in-network or out-of-network. All of it adds up. And if you don’t understand how these pieces fit together, you could end up paying way more than you expected.

Understanding your insurance plan type - copay, deductible, or coinsurance?

Not all insurance plans work the same way. There are three main structures for how you pay for therapy, and each changes your total cost dramatically.

- Copay plans: You pay a fixed amount per session - like $30 or $50 - regardless of the actual cost of the session. This is the simplest. But only if your deductible is already met.

- Deductible plans: You pay the full price of each session until you hit your deductible. For example, if your deductible is $1,500 and your therapist charges $125 per session, you’ll pay $125 for the first 12 sessions before insurance kicks in.

- Coinsurance plans: After you meet your deductible, you pay a percentage of the cost - usually 20% to 40%. So if your session costs $125 and your coinsurance is 20%, you pay $25. But here’s the catch: the insurance company only recognizes a certain amount as “allowed.” If your therapist charges $150 but the allowed amount is $125, you still only pay 20% of $125.

Most people assume their copay is their only cost. But if you haven’t met your deductible, that $30 copay doesn’t apply yet. You’re paying full price - and that can be $100 to $200 per session depending on where you live. In New York, the average session is $176. In North Dakota, it’s $227. Location matters.

How your deductible can double your therapy costs - before you even see a copay

Let’s say your annual deductible is $1,500. You’ve seen your therapist 10 times already this year. Each session was $125. You’ve paid $1,250. You’re close. But you still need 5 more sessions to meet your goal. That’s another $625 - and you haven’t paid a single copay yet.

This is where people get blindsided. They think, “I have insurance, so therapy should be cheap.” But until your deductible is met, you’re paying full price. And if your therapist charges more than what your insurance considers “usual and customary,” you’re on the hook for the difference.

For example, if your therapist charges $150 per session but your insurance only allows $125, you pay $150 - not $125. That $25 difference doesn’t count toward your deductible. You’re paying extra, and it doesn’t help you get closer to insurance coverage. This is called “balance billing,” and it’s common with out-of-network providers.

That’s why it’s critical to ask your therapist: “What’s your fee? And what’s your insurance allowed amount?” If they don’t know, they might not be in-network. And if they’re not in-network, your costs could balloon.

Coinsurance isn’t just a percentage - it’s a hidden cost multiplier

Once you meet your deductible, coinsurance kicks in. Sounds fair, right? But here’s the problem: coinsurance applies to every session, even if you need 30, 40, or 50 sessions over the year.

Let’s say your deductible is $3,000, your coinsurance is 20%, and your therapist charges $125 per session. You need 24 sessions to feel better.

- First 24 sessions at $125 = $3,000 total. You pay $3,000 to meet your deductible.

- After deductible: 24 sessions × $125 = $3,000. You pay 20% = $600.

- Total out-of-pocket: $3,600.

That’s $3,600 for therapy - and you’re still paying your monthly premium on top of that. Now imagine you need 40 sessions. Your coinsurance kicks in after $3,000, so you pay 20% of $5,000 (the remaining cost). That’s $1,000. Total: $4,000.

And here’s the kicker: your out-of-pocket maximum is $9,350 for an individual plan in 2024. That means if you have other medical needs - a broken bone, a hospital visit, a prescription - those costs also count toward your max. But if your mental health coverage has a separate deductible? Then your therapy costs don’t help you reach your medical out-of-pocket cap. You’re paying twice.

In-network vs. out-of-network: The $100 difference you can’t ignore

Therapists who are “in-network” have agreed to accept your insurance’s allowed amount as payment in full. That’s a big deal. Out-of-network therapists don’t. That means they can charge whatever they want - and you pay the difference.

For example:

- In-network therapist: $125 per session. Insurance allows $125. You pay $40 copay after deductible.

- Out-of-network therapist: $180 per session. Insurance allows $125. You pay $180. Then you submit a claim. Insurance reimburses you 50% of $125 = $62.50. So you’re still out $117.50 per session.

That’s $77.50 more per session than if you’d chosen an in-network provider. For 20 sessions? That’s $1,550 extra.

And if you’re on Medicare? Out-of-network therapy isn’t covered at all unless you have a Medigap Plan G. Otherwise, you pay 100%. That’s why 42% of therapists offer sliding scale fees - because insurance alone doesn’t make therapy affordable.

What you’re not counting: premiums, transportation, and medication

Therapy isn’t just the session fee. You’re also paying your monthly insurance premium - even if you never use therapy. That’s $200-$500 a month for many plans. That’s $2,400-$6,000 a year just to have the option.

Then there’s transportation. If you’re driving 45 minutes each way, that’s 90 minutes of time and gas money. For weekly therapy, that’s 78 hours a year - and $100-$200 in fuel. Not a small thing.

And if you’re on medication? Many people take antidepressants, mood stabilizers, or anti-anxiety meds alongside therapy. A 30-day supply of generic sertraline can cost $10 with insurance. Without? $150. That’s $120 extra a month. Add that to therapy, and you’re looking at $500-$700 a month.

Most people don’t track these together. But they all add up to your real cost of treatment.

How to actually calculate your total therapy cost - step by step

Here’s how to figure out what you’ll really pay - no guesswork.

- Find your plan type. Call your insurer or log into your portal. Ask: “Is my mental health coverage based on copay, deductible, or coinsurance?”

- Ask your therapist. “What’s your fee? What’s your in-network allowed amount? Are you in-network with my plan?”

- Check your deductible status. How much have you paid this year? How much is left? If you’ve paid $1,000 of a $1,500 deductible, you’re 2/3 of the way there.

- Estimate your sessions. Most people need 12-20 sessions for meaningful progress. If you’re dealing with trauma or depression, plan for 20+.

- Calculate in phases:

- Phase 1 (pre-deductible): Full session cost × sessions until deductible is met.

- Phase 2 (post-deductible): Copay or coinsurance × remaining sessions.

- Phase 3 (out-of-pocket max): Your total can’t exceed $9,350 (individual) in 2024 - but only if all services count toward the same cap.

Example: Deductible $1,500, session cost $125, 20 sessions, $40 copay after deductible.

- Phase 1: $1,500 (12 sessions × $125)

- Phase 2: $40 × 8 sessions = $320

- Total: $1,820

That’s a 41% savings compared to paying full price. But only if you know how to calculate it.

What to do if you can’t afford therapy - even with insurance

Not everyone can pay $1,800 a year for therapy. Here are real options:

- Sliding scale fees: 42% of private therapists offer income-based rates. Ask. You might pay $50 instead of $125.

- Open Path Collective: A nonprofit network offering sessions for $40-$70 to uninsured or underinsured people.

- University clinics: Graduate students provide therapy under supervision. Often 50-70% cheaper.

- Community health centers: Federally funded clinics offer mental health services on a sliding scale.

- Teletherapy apps: Platforms like Rula report average copays of $15-$25 for insured users - sometimes lower than in-person.

And if you’re on Medicaid? Many plans have $0 copays. If you’re on Medicare? You pay 20% of the allowed amount - usually around $28 per session. That’s affordable. But you still need to track your deductible and out-of-pocket max.

Final tip: Don’t wait until you’re overwhelmed to check your costs

Almost 40% of people say they didn’t know their therapy copay until after they’d already paid for several sessions. That’s avoidable.

Call your insurance provider. Ask for your mental health benefits summary. Write down:

- Monthly premium

- Deductible amount and status

- Copay or coinsurance rate

- Out-of-pocket maximum

- In-network vs. out-of-network rules

Then call 2-3 therapists and ask the same questions. Compare. Budget. Plan.

Therapy is worth it. But only if you can afford it. And you can’t afford it if you don’t know how much it costs.

Is my therapy copay the only thing I pay?

No. Your copay is just one part. You might also pay your monthly insurance premium, your annual deductible (before copay applies), coinsurance after the deductible, and out-of-network fees. All of these add up. For example, if you haven’t met your $1,500 deductible, you could be paying $125 per session - not $30 - until you hit that number.

Why does my out-of-pocket cost keep rising even after I start paying a copay?

Because you’re likely on a coinsurance plan. After meeting your deductible, you pay a percentage (like 20%) of each session’s allowed amount. If your therapist charges $125 and your coinsurance is 20%, you pay $25 per session. But if you need 30 sessions, that’s $750 just in coinsurance - not counting your deductible. That’s why total costs can climb even after the copay kicks in.

Does therapy from an out-of-network provider count toward my deductible?

Sometimes - but not always. Some plans only count in-network services toward your deductible. Others will count out-of-network payments, but only up to the insurance company’s allowed amount. For example, if your therapist charges $180 but the allowed amount is $125, only $125 counts toward your deductible. You pay the extra $55, but it doesn’t help you reach your goal faster.

Can I use other medical expenses to meet my mental health deductible faster?

Yes - if your plan has a combined deductible. Most plans combine medical and mental health costs into one deductible. So if you’ve had a doctor visit, lab test, or prescription that counts toward your deductible, those payments help you reach your mental health coverage faster. But some plans have separate deductibles for mental health. Always check.

What’s the maximum I’ll ever pay for therapy in a year?

For an individual plan in 2024, the out-of-pocket maximum is $9,350. That includes all deductibles, copays, and coinsurance for in-network services. Once you hit that, your insurance covers 100% of covered services for the rest of the year. But if your mental health has a separate deductible, you might pay more than that just for therapy. Always confirm your plan’s structure.

Shayne Smith

December 7, 2025 AT 05:32Wow, I had no idea therapy could cost this much under the hood. I just thought 'copay = done'. This is eye-opening. Thanks for laying it out like this.

Brooke Evers

December 7, 2025 AT 14:50This is so important. I spent six months paying $110 a session thinking I was covered, only to find out my deductible was $3k and I hadn’t met it. By the time I realized, I’d already spent $2,200. No one warned me. Please, if you’re reading this - call your insurer. Don’t wait until you’re in crisis.

Chris Park

December 8, 2025 AT 21:03Of course insurance is designed to confuse you. They want you to think you’re covered - then hit you with balance billing, separate deductibles, and allowed amounts that make no sense. It’s not incompetence - it’s business. Mental health is profitable only when you’re paying out of pocket.

Clare Fox

December 10, 2025 AT 18:36i always thought my $40 copay was it… turns out i’ve been paying $130 a session for 8 months and didn’t even know it. my brain feels like mush and my bank account feels like a ghost town. thanks for the wake up call. also… why is this not on the insurance website? it’s like they want us to fail.

Ashish Vazirani

December 11, 2025 AT 16:41Why are we even paying for this system?! In India, you can get therapy for ₹500/month - that’s like $6! Here, you’re being gouged because it’s ‘healthcare’ - but it’s really a luxury for the rich. The whole insurance model is a scam. They profit from your suffering. I’m done.

Mansi Bansal

December 12, 2025 AT 06:12It is imperative to underscore that the structural inequities embedded within the American mental health infrastructure are not merely incidental - they are systemic, deliberate, and profoundly dehumanizing. The conflation of therapeutic access with socioeconomic privilege constitutes a moral failure of the highest order. One cannot, in good conscience, refer to this as ‘healthcare’ when the cost of healing is contingent upon one’s financial standing.

olive ashley

December 13, 2025 AT 00:20Let’s be real - if your therapist doesn’t immediately tell you their allowed amount and whether they’re in-network, run. They’re either clueless or they’re hiding something. I had one who said ‘Oh, I’m in-network with everyone!’ - turned out she wasn’t in-network with mine. I got billed $200 for a session. I cried in the parking lot. Don’t be me.

Myles White

December 14, 2025 AT 01:39I’ve been doing this for years - tracking every dollar spent on therapy, premiums, meds, gas, even the coffee I buy before sessions. It’s exhausting, but necessary. Here’s my spreadsheet template: I break it into four categories - insurance payments, out-of-pocket therapy, meds, and indirect costs (time, transport, missed work). Last year, I spent $5,217. That’s not ‘therapy cost’ - that’s ‘survival cost.’ If you’re not tracking this, you’re flying blind. And you will get wrecked.

Saketh Sai Rachapudi

December 15, 2025 AT 00:38Why do we let these companies get away with this? In my country, healthcare is a right - not a privilege. Here? You pay or you suffer. And if you’re poor? Good luck. The system is rigged. And the people who benefit? They’re not even in this country - they’re in hedge funds. This isn’t healthcare - it’s capitalism with a stethoscope.

Akash Takyar

December 15, 2025 AT 23:56Thank you for sharing this. Many people, especially in my community, feel ashamed to ask about costs - but this is not about shame, it’s about survival. I’ve recommended Open Path to three friends already. If you’re struggling financially, please don’t give up. There are options. You are worth the help - even if the system says otherwise.

Nigel ntini

December 17, 2025 AT 00:30Just wanted to add - if you’re on a coinsurance plan and your therapist charges more than the allowed amount, ask if they’ll accept the allowed amount as payment in full. Some will, especially if you explain you’re on a tight budget. I negotiated mine down from $150 to $125 just by asking. No one tells you this - but you can ask.

Ibrahim Yakubu

December 18, 2025 AT 03:22I work in a community clinic. We see people who pay $10, $20, $30 - sometimes nothing - because we know therapy shouldn’t be a luxury. But we’re overwhelmed. There are only so many sliding scale spots. If you can afford to pay full price, please do. It helps us keep the door open for those who can’t. This system is broken - but we’re trying to fix it, one session at a time.

Arjun Deva

December 18, 2025 AT 12:17Wait - so this whole time, the government knew this was happening? And they let it? And now they want us to trust them with our mental health? That’s not a system. That’s a trap. They’re not trying to help - they’re trying to make you pay until you break. And then they’ll say ‘you need more therapy.’ It’s a loop. It’s designed to keep you poor and dependent. I’m not falling for it.