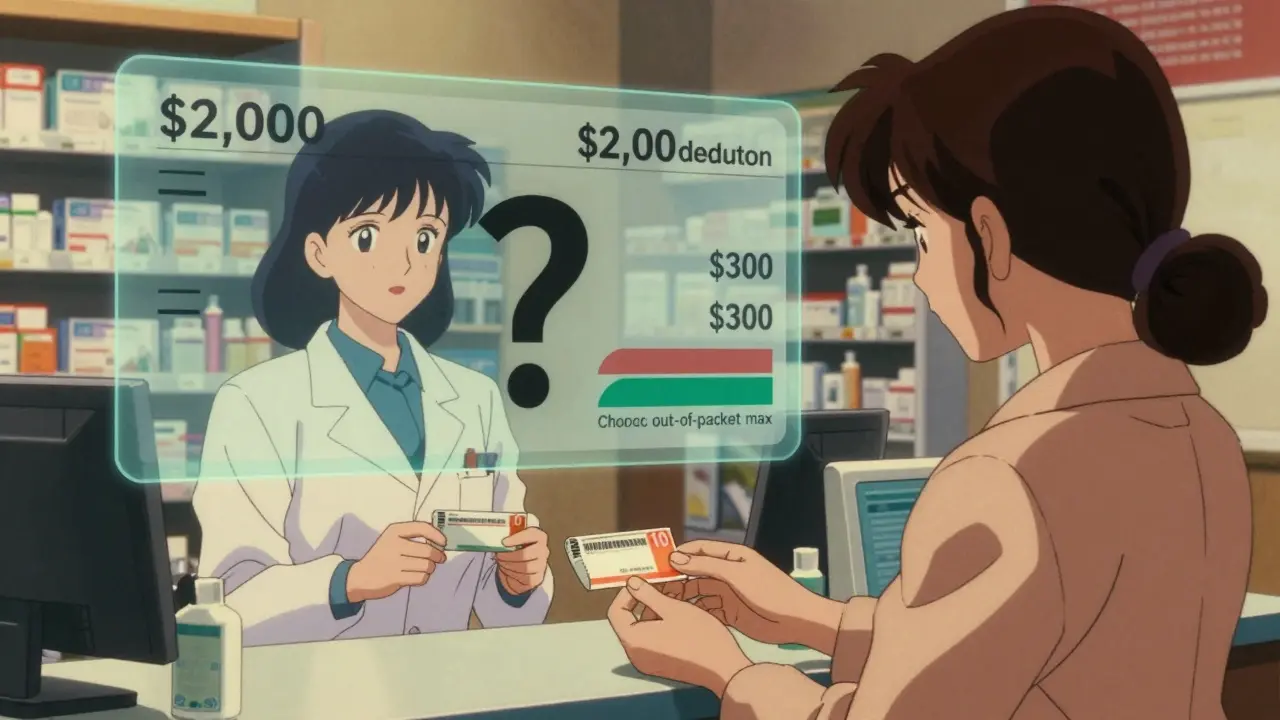

Every year, millions of people pay their prescription copays without realizing they’re not helping them meet their deductible. That’s not a mistake-it’s how most health plans are designed. If you’re taking a daily medication like blood pressure pills or insulin, you might think each $10 copay is chipping away at your $2,000 deductible. But here’s the truth: generic copays usually don’t count toward your deductible. They do, however, count toward your out-of-pocket maximum. And that difference could save you thousands.

What’s the difference between a deductible and an out-of-pocket maximum?

Your deductible is the amount you pay before your insurance starts sharing costs. For example, if your deductible is $1,500, you pay 100% of covered medical bills until you’ve spent that much. After that, you pay coinsurance-say, 20%-and your plan pays 80%.

Your out-of-pocket maximum is the most you’ll pay in a year for covered services. Once you hit that number, your insurance covers 100% of everything else for the rest of the year. For 2026, the federal limit is $10,600 for an individual and $21,200 for a family.

Here’s the key: all your in-network spending-deductibles, coinsurance, and copays-counts toward that out-of-pocket maximum. But only some of it counts toward your deductible. And generic prescription copays? They almost never count toward your deductible.

Why do generic copays count toward the out-of-pocket maximum but not the deductible?

This setup comes from the Affordable Care Act (ACA), which took full effect in 2014. Before then, copays didn’t count toward anything. You could pay $500 in insulin copays in a year and still be nowhere near your deductible. That left people with chronic conditions stuck paying out of pocket forever.

The ACA fixed that by requiring all cost-sharing-copays, coinsurance, and deductibles-to count toward the out-of-pocket maximum. That means if you’re on a $10 generic drug copay and take 30 prescriptions a year, you’re paying $300. That $300 goes toward your out-of-pocket maximum. If your max is $8,500, you’re now $300 closer to getting your meds free for the rest of the year.

But your deductible? That’s a separate track. You still have to pay your $1,500 in medical bills before coinsurance kicks in. Your $300 in copays doesn’t reduce that number. It’s like two separate toll roads: one leads to your deductible, the other leads to your out-of-pocket max. You can pay on both, but only one gets you closer to your goal.

How do different plan types handle prescription costs?

Not all plans work the same way. There are three main models:

- Single deductible (27% of employer plans): Your medical and prescription costs both count toward one deductible. Once you hit it, you pay coinsurance on everything. In these plans, you usually don’t have copays-you pay a percentage of the drug cost until you meet the deductible.

- Separate medical and prescription deductibles (37% of plans): You have two deductibles. You pay full price for prescriptions until you meet the prescription deductible (say, $500). After that, you pay a $10 copay. That $10 copay counts toward your out-of-pocket max, but not your medical deductible.

- Copay-only with no prescription deductible (36% of plans): You pay the $10 copay right away, no deductible to meet. Again, that $10 counts toward your out-of-pocket max, but not your medical deductible.

Most people assume their plan is #1. But if you’re paying copays for prescriptions, you’re likely in #2 or #3. That’s why you can pay $2,500 in copays and still not be close to your $2,000 deductible.

Real stories: What happens when people get confused?

One user on HealthCare.gov wrote: “I paid $10 for my blood pressure med every month for a year. I thought I’d met my $2,000 deductible. I was shocked when my doctor said I still owed $1,800.”

Another person on Reddit said: “I had a $3,000 deductible and paid $1,200 in insulin copays. I thought I was halfway there. Turns out I was zero percent there.”

These aren’t rare cases. A 2023 survey found that 68% of consumers believe prescription copays count toward their deductible. Only 22% got it right.

But there’s good news, too. People with chronic conditions often praise the out-of-pocket maximum. One person with diabetes shared: “Before 2014, my $15 insulin copays didn’t get me anywhere. Last year, I hit my $8,500 out-of-pocket max in October. After that, my insulin was free. That saved me over $2,000.”

How to find out how your plan really works

You can’t guess. You have to check.

Look for your plan’s Summary of Benefits and Coverage (SBC). It’s required by law and must be given to you before you enroll. It’s a 2-4 page document with a standardized format. Look for these sections:

- “Does this payment count toward my deductible?”-Check this for prescriptions.

- “Prescription Drug Coverage”-See if there’s a separate prescription deductible.

- “Out-of-Pocket Maximum”-Confirm it includes copays.

Also check your Explanation of Coverage document. It’s longer and more detailed. If you’re on an employer plan, ask HR for both documents. Don’t rely on what your pharmacist or doctor says-they often don’t know the fine print.

What’s changing in 2025 and beyond?

The government is trying to fix the confusion. Starting in 2025, insurers must make it clearer on bills and statements whether a copay counts toward your deductible or just your out-of-pocket maximum.

Some insurers are testing “integrated deductible” plans-where prescription copays count toward your main deductible. Early results show patients take their meds more consistently when they see progress.

By 2027, experts predict 60% of major insurers will offer at least one plan where generic copays count toward the deductible. But that’s not here yet. Most plans still keep them separate.

What you should do right now

If you take regular prescriptions:

- Find your SBC and Explanation of Coverage documents.

- Look for the “Prescription Drug” section.

- Check if there’s a separate prescription deductible.

- See if copays are listed as counting toward your deductible (they probably aren’t).

- Confirm they count toward your out-of-pocket maximum (they should).

- Track your copay spending. Add it up. See how close you are to your out-of-pocket max.

If you’re close to your out-of-pocket maximum, you might qualify for free meds soon. If you’re far from your deductible, don’t assume you’re making progress. You’re not.

Don’t let confusion cost you money. Know your plan. Know your numbers. And if you’re paying for prescriptions every month, make sure you’re actually getting closer to relief-not just spending more.