Employer health plans are insurance plans provided by employers that include prescription drug coverage structured through tiered formularies. These plans prioritize generic medications to control costs while ensuring safe and effective treatment. Did you know generic drugs save $3 billion every week? Yet many employees don't know how to use generic medications effectively. Let's break down how employer health plans handle them and what you need to know.

How Employer Health Plans Structure Drug Coverage

Formulary tiers are cost-sharing levels used in prescription drug coverage, typically divided into four tiers based on medication type and cost. Most employer health plans use a tiered system for prescription drugs. Tier 1 usually covers generic medications with a $10 copay. Tier 2 includes preferred brand-name drugs at $40. Tier 3 is non-preferred brands at $75, and Tier 4 is specialty drugs with higher costs. These numbers come from the Ohio Department of Administrative Services in 2023.

When a brand-name drug becomes available as a generic, Pharmacy Benefit Managers (PBMs) like OptumRx automatically move the generic to Tier 1 and the brand to Tier 4. This means employees who choose the brand-name version pay much more. For example, if you take a medication like metformin for diabetes, it's likely in Tier 1. But if you switch to a brand-name version like Glucophage, you'll pay more. Check your plan's formulary to see which tier it's in.

Why Generics Are the Go-To Choice

Generic medications are FDA-approved drugs that are chemically identical to brand-name versions but cost 80-85% less because manufacturers avoid clinical trials, advertising, and marketing expenses. The FDA confirms they're just as safe and effective. Schauer Group found that generics save $3 billion weekly, totaling over $150 billion annually. Employers push for generics because they cut costs without sacrificing quality.

Checking Your Plan's Coverage

How do you know if your medication is covered? Start by visiting your insurer's website. Look for the formulary list specific to your plan. Most insurers have a search tool where you can enter your drug name. You can also check your Summary of Benefits and Coverage (SBC) document, which explains what's covered. If you're unsure, call your insurer directly. For example, Anthem's Ohio plan has six different drug lists depending on your employer's coverage type. Remember that formularies change often-sometimes without notice-so check regularly.

What If Your Drug Isn't Covered?

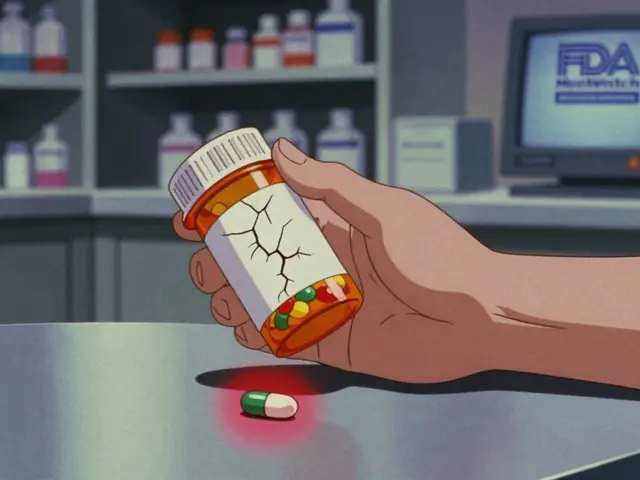

Pharmacy Benefit Managers (PBMs) frequently update formularies. In January 2024, OptumRx, CVS Caremark, and Express Scripts each removed over 600 drugs. If your medication is excluded, contact your employer's HR department. They can help request a medical necessity exception. A doctor can write a letter explaining why you need the specific drug. Some plans allow exceptions if generic alternatives aren't suitable. HealthOptions.org's Care Managers also help members find affordable options. For instance, their Price Assure Program automatically saves money on generics at in-network pharmacies.

The Role of PBMs and Hidden Costs

Pharmacy Benefit Managers are companies like OptumRx, CVS Caremark, and Express Scripts that manage drug coverage for employers. They negotiate prices with drug manufacturers and set formulary tiers. PBMs use gross-to-net pricing, which is the difference between a drug's list price and what they actually pay after rebates. KPMG estimates the average gross-to-net spread is 55%. This means if a drug's list price is $100, PBMs pay about $45. However, these savings don't always reach you. Scott Glovsky explains that PBMs often keep rebates instead of lowering copays. For example, a generic might cost $10 to you, but the PBM gets a $5 rebate-so you still pay $10 while the PBM profits.

Practical Tips to Save Money

Here's how to navigate employer health plans effectively:

- Ask for generics: When your doctor prescribes a brand-name drug, ask if a generic is available.

- Use in-network pharmacies: These often have lower copays for generics.

- Check formularies regularly: Changes happen often-stay updated.

- Explore assistance programs: Some employers offer programs like HealthOptions.org's Price Assure for automatic savings.

- Work with HR: If your drug is excluded, they can help request exceptions.

How do I find out if my medication is covered?

Check your insurer's website for the formulary list specific to your plan. Most insurers have a search tool where you can enter your drug name. You can also check your Summary of Benefits and Coverage (SBC) document or call your insurer directly. For example, Anthem's Ohio plan has six different drug lists depending on your employer's coverage type.

Why do generic drugs cost so much less?

Generic medications are FDA-approved and chemically identical to brand-name drugs but cost 80-85% less because manufacturers skip expensive clinical trials, advertising, and marketing. The FDA confirms they're just as safe and effective. Schauer Group reports generics save $3 billion weekly, totaling over $150 billion annually.

What should I do if my drug is removed from the formulary?

Contact your employer's HR department immediately. They can help request a medical necessity exception where a doctor explains why you need the specific drug. Some plans allow exceptions if generic alternatives aren't suitable. HealthOptions.org's Care Managers also assist in finding affordable options, like their Price Assure Program for generics at in-network pharmacies.

How do PBMs affect my drug costs?

Pharmacy Benefit Managers (PBMs) like OptumRx, CVS Caremark, and Express Scripts manage drug coverage for employers. They negotiate prices and set formulary tiers. PBMs use gross-to-net pricing, where the average spread is 55%. This means if a drug's list price is $100, PBMs pay $45 after rebates. However, these savings often don't lower your copay-PBMs may keep the rebates instead of passing them to you.

Are there programs to help lower generic medication costs?

Yes, many employers offer assistance programs. HealthOptions.org's Price Assure Program automatically saves money on generics when filled at in-network pharmacies. Some plans have tiered copays where generics cost $10 compared to $40 for brand-name drugs. Always check with your HR department about available programs.

Pamela Power

February 6, 2026 AT 06:41PBMs are the real villains here. They take advantage of the gross-to-net pricing scheme, pocketing rebates instead of lowering your copays. For example, if a drug's list price is $100, PBMs pay $45 but you still get charged the same.

This is why generics are pushed-they're cheaper for PBMs to manage. The FDA says generics are safe, but I've seen reports of generics with contaminants.

Employers don't care-they just want lower premiums. This 'guide' is just brushing it under the rug. You're better off paying cash.

Always check your formulary, but know the system is rigged. PBMs are in bed with drug companies. They'll remove your meds from the formulary to push you to a more expensive option.

Don't trust any of this. It's all about profit. I've had to fight with my insurer before to get a generic covered. They kept insisting on the brand. It's a scam. The whole system is designed to keep you paying more. Wake up, people.

Bella Cullen

February 6, 2026 AT 08:38I take generics without issues.

Cullen Bausman

February 6, 2026 AT 20:25Americans must take responsibility for their health. Generics are safe and cheaper. PBMs are necessary. Stop complaining.

Arjun Paul

February 7, 2026 AT 19:07This system is broken. PBMs are profiteering. We should not trust them.

Dr. Sara Harowitz

February 8, 2026 AT 12:38PBMs are destroying the healthcare system! They are greedy! The government must regulate them immediately! This 'guide' is misleading! It's all about the money!

Andre Shaw

February 9, 2026 AT 00:57Actually, generics aren't always safe. Many have different inactive ingredients that can cause issues. The FDA's approval process is flawed. You should always check the manufacturer.

Lisa Scott

February 9, 2026 AT 16:08PBMs are part of a bigger conspiracy to control our health. They work with Big Pharma to keep us sick. The FDA is in on it. Always check the source of your meds.

Elliot Alejo

February 10, 2026 AT 17:07I've found that using generics saves me money without any issues. It's great that employers are pushing this. Always check with your HR for assistance programs.

Lana Younis

February 11, 2026 AT 01:24Genarics are totally fine for most people. Sometimes the brand is better but usually the generic works. Chek your formulary and ask HR if unsure. They can help.